nys workers comp taxes

Workers Comp Exemptions in New York. Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of.

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

. 20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. Information for Employers regarding Workers Compensation Coverage.

The Advocate for Business offers educational presentations on topics important to business such as an. This tax exempt status applies if the worker receives. If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits.

New York State Insurance Fund- SIF. Begin the process by filing a C-3 employee claim. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Ny state workers compensation rates nys workers comp rates 2020 nys workers compensation rate schedule nys workers compensation insurance rates new york workers compensation. To register you must have a federal employer identification number EIN. In New York state law requires employers to cover all employees with workers compensation and disability insurance.

It protects employers from liability for on-the-job injury or illness and provides the following. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. The quick answer is that generally workers compensation benefits.

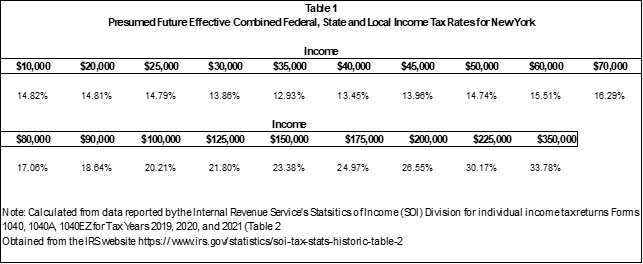

Workers compensation excludable earnings will be calculated and processed every pay cycle beginning with Administration paychecks dated 81215 and. Failure to comply with state workers compensation insurance rules can. The Employer Compensation Expense Program ECEP established an optional Employer Compensation Expense Tax ECET that employers can elect each year to pay if they have employees that earn over 40000 annually in wages and compensation in New York State.

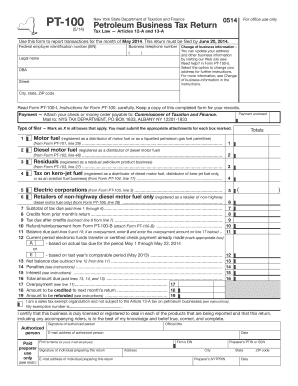

Payable to the New York State Department of Taxation and Finance within two and one half months of the close of the reporting period Tax Law Article 33. New York State Workers Compensation Board. Workers compensation is overseen by the New York State Workers Compensation Board aka The Board with headquarters in Schenectady.

Workers compensation insurance is mandatory for most employers of one or more employees. You and your employee agree to withhold New York State income tax from your employees wages. Employees of participating employers may be eligible to claim the ECEP wage credit when.

The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. The amount you receive as workers. According to IRS Publication 525 page 19 workers comp does not generally count as earned income for federal income tax purposes.

The Workers Compensation Board is a state agency that processes the claims.

New York State Workers Compensation Board Youtube

B I C Brokerage Corp New York Ny Facebook

Nys Workers Compensation Audits

Section 2 Calculation Of Loss Compensation Vcf

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

The Ultimate Guide To Workers Compensation Laws In New York

New York Household Employment Tax And Labor Law Guide Care Com Homepay

Nys Workers Compensation Future Medical Settlements Paul Giannetti

Time For A Real Look At How The New York State Workers Compensation System Treats Workers Center For New York City Affairs

Commentary Reports On The Nys Workers Compensation Board

C3 Form Fill Online Printable Fillable Blank Pdffiller

N Y Don T Leave Money On The Table This Tax Season New York Daily News

Workers Compensation Laws By State Embroker

Workers Compensation Software Get A Free Quote Quickbooks

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

Ny Workers Compensation Insurance Get Insured Fast

Workers Compensation Insurance In New York Cerity

The Complete Guide To New York Payroll Payroll Taxes 2022

Employee Vs Independent Contractor How Ny Workers Compensation Impacts Each Littman Babiarz